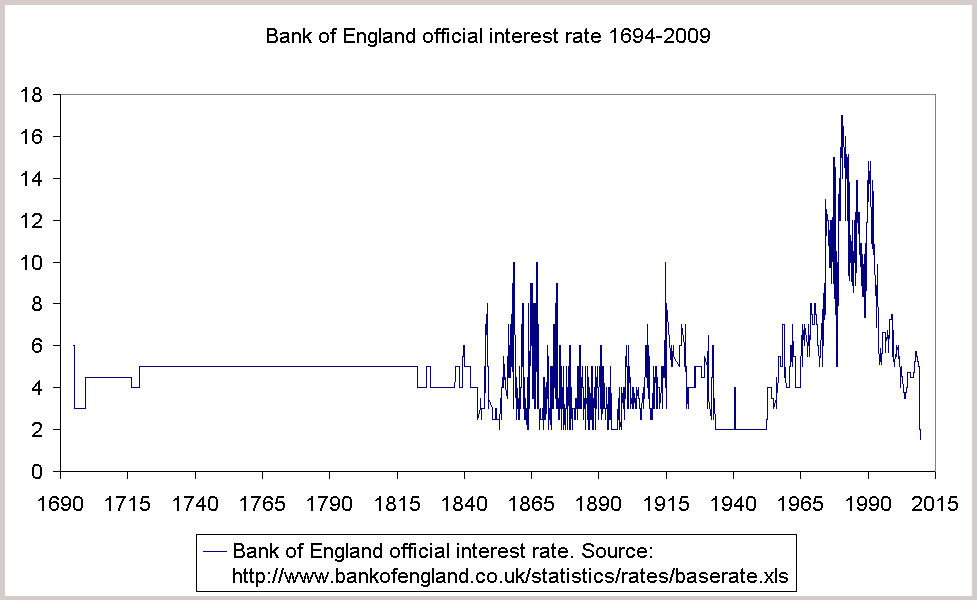

UK official interest rate at 315 year low

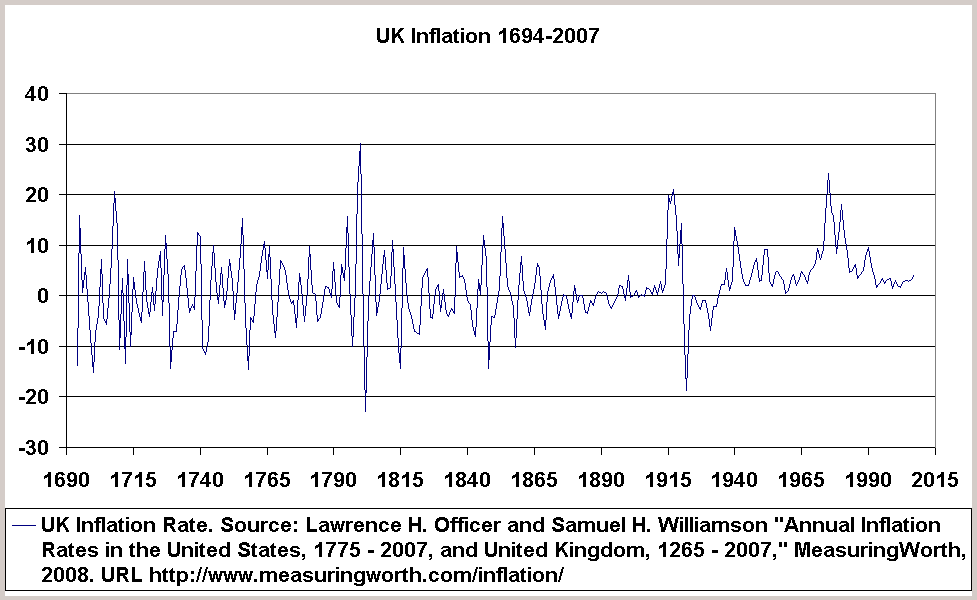

Last week, the UK reduced its interest rate to the lowest level ever in its 315 year history. I found this surprising since there is very little in terms of economic environment that the Bank of England has not seen in these three centuries. It is all the more puzzling when the interest rate graph is juxtaposed with a graph of inflation rates (see figures below).

It is interesting to see that negative inflation rates are quite common prior to the twentieth century. The average inflation rate was negative in the entire nineteenth century. But even in this period, while interest rates went down to 2% on several occasions, they never dropped to the 1.5% level reached last week.

What is also interesting is that for 103 years from 1719 to 1822, the Bank of England did not change its rate even once. England lost an empire in one continent while gaining an empire in another; it fought the Seven Years War and the Napoleonic wars; inflation rates ranged from +30% to -23%, but interest rates remained fixed at 5%!

Deflation was quite common in the eighteenth and nineteenth centuries, and apparently was not damaging to growth. Perhaps, there is something pernicious about fiat (paper) money that makes inflation and deflation so scary. Under the gold standard, the price level had a tendency to mean revert so that high inflation was followed quickly by deflation; therefore even 30% inflation did not create inflationary expectations, and even 20% deflation did not create deflationary expectations.

Posted at 1:17 pm IST on Mon, 12 Jan 2009 permanent link

Categories: financial history, monetary policy

Comments