Option pricing with bimodal distributions

Jack Schwager’s book Hedge Fund Market Wizards has a chapter on James Mai of Cornwall Capital in which Mai talks about seeking opportunities in mispriced options. Many of us know about Mai from Michael Lewis’ Big Short which described how Mai made money by betting against subprime securities. But in the Schwager book, Mai talks mainly about options. Specifically, at page 232, Mai discusses opportunities “where the market assigned normal probability distributions to situations that clearly had bimodal outcomes”.

At first reading, I thought that Mai was simply talking about fat tails and the true volatility being higher than the option implied volatility. But on closer reading, this does not appear to be the case. In another section of the interview, Mai talks about the market under estimating the volatility of the distribution, while at another point, he describes the market making mistakes in the mean of the option implied distribution. So it does appear that Mai is distinguishing between errors in the mean, the volatility and the shape of the distribution.

This set me thinking about whether the bimodality of the distribution would make a big difference if the market assumes a (log) normal distribution with the correct mean and variance. Bimodality is very different from fat tails. In fact, if the distribution around each of the two modes is tight, then the tails are actually very thin. The departure from normality is actually a hollowing out of the middle of the distribution. For example, one may believe that a stock would either go to near zero (bankruptcy) or would double (if the risk of bankruptcy is eliminated) – the probability that the stock would remain close to the current level may be thought to be quite small. Mai himself discusses such an example.

To understand the phenomenon, let us take an extreme case of bimodality where there are actually only two outcomes. For simplicity, I assume that the risk free rate is zero. To facilitate comparison with the log normal distribution, I assume that the distribution of log asset prices is symmetric. If the current asset price is equal to 1, then by log symmetry, the two outcomes must be H and 1⁄H. Since the two possible outcomes of the log price are ± ln H, the volatility is ln H assuming that the option maturity is 1. The risk neutral probabilities of the two outcomes (p and 1 − p) are easy to compute. Since the risk free rate is zero, p H + (1 − p) 1⁄H = 1 implying that p = 1 ⁄ (1 + H) and 1 − p = H ⁄ (1 + H). (Unless H is quite large, these probabilities are not very far from 1⁄2).

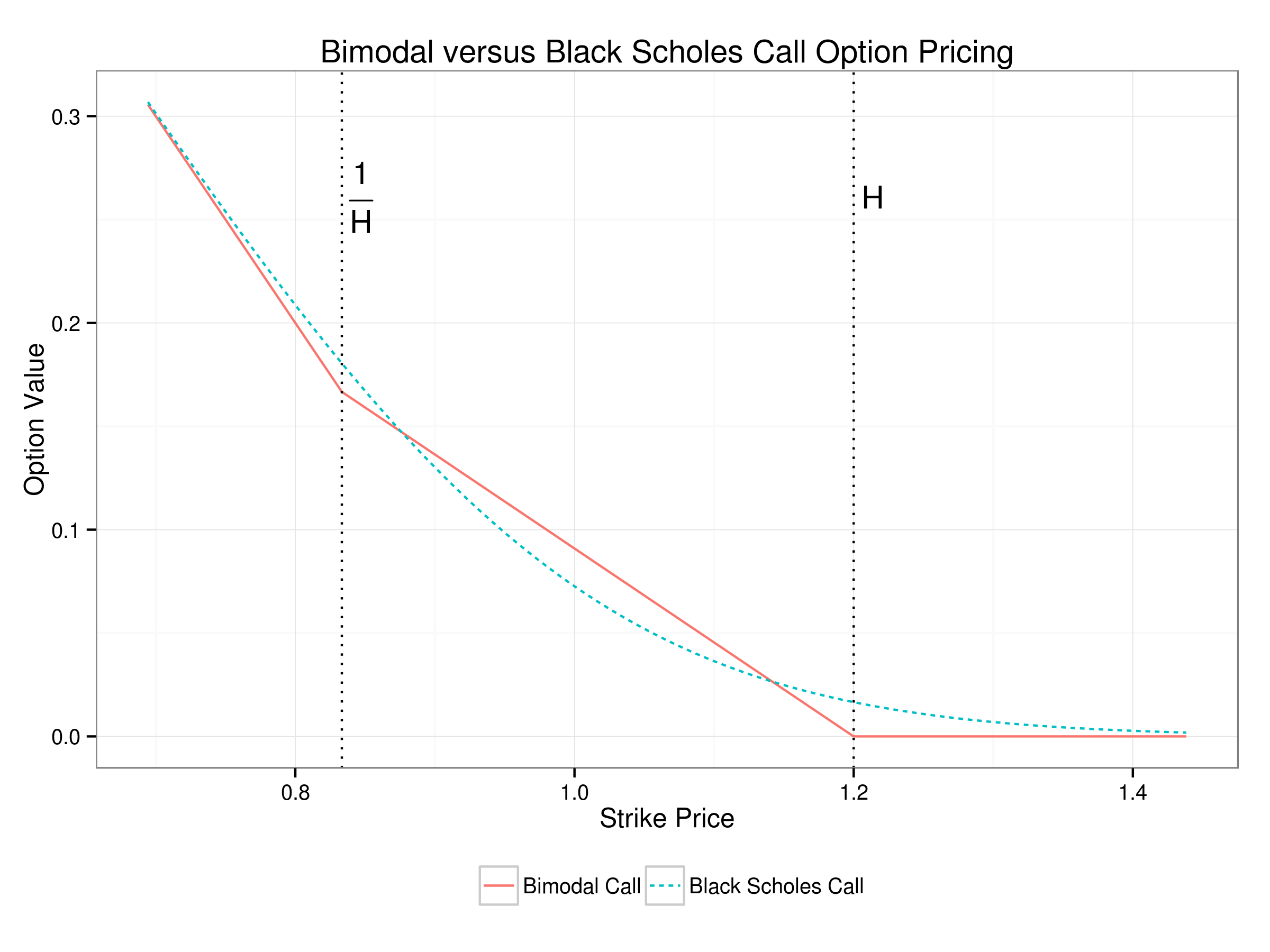

With all these computations in place, it is straightforward to compare the true bimodal option price with that obtained by the Black Scholes formula using the correct volatility. The plot below is for H = 1.2.

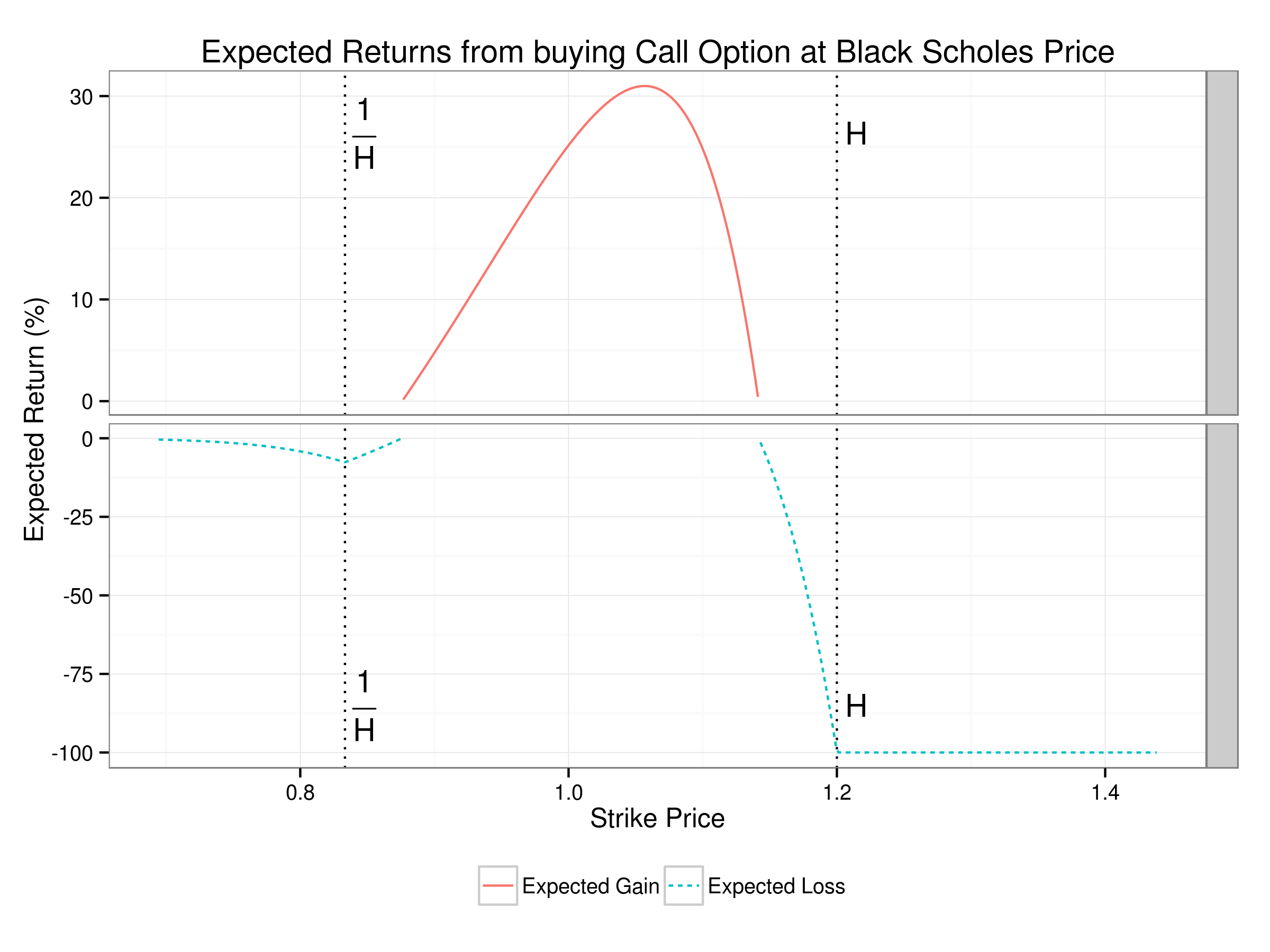

It might appear that the impact of the bimodal distribution is quite small. However, the important question is what is the expected return from buying an option at the wrong (Black Scholes) price in the market and holding it to maturity. The plot below shows that the best strategy is to buy an option with a strike about 6% out of the money. This earns a return of almost 31% (there is a 45% chance of earning a return of 188% and a 55% chance of losing 100%).

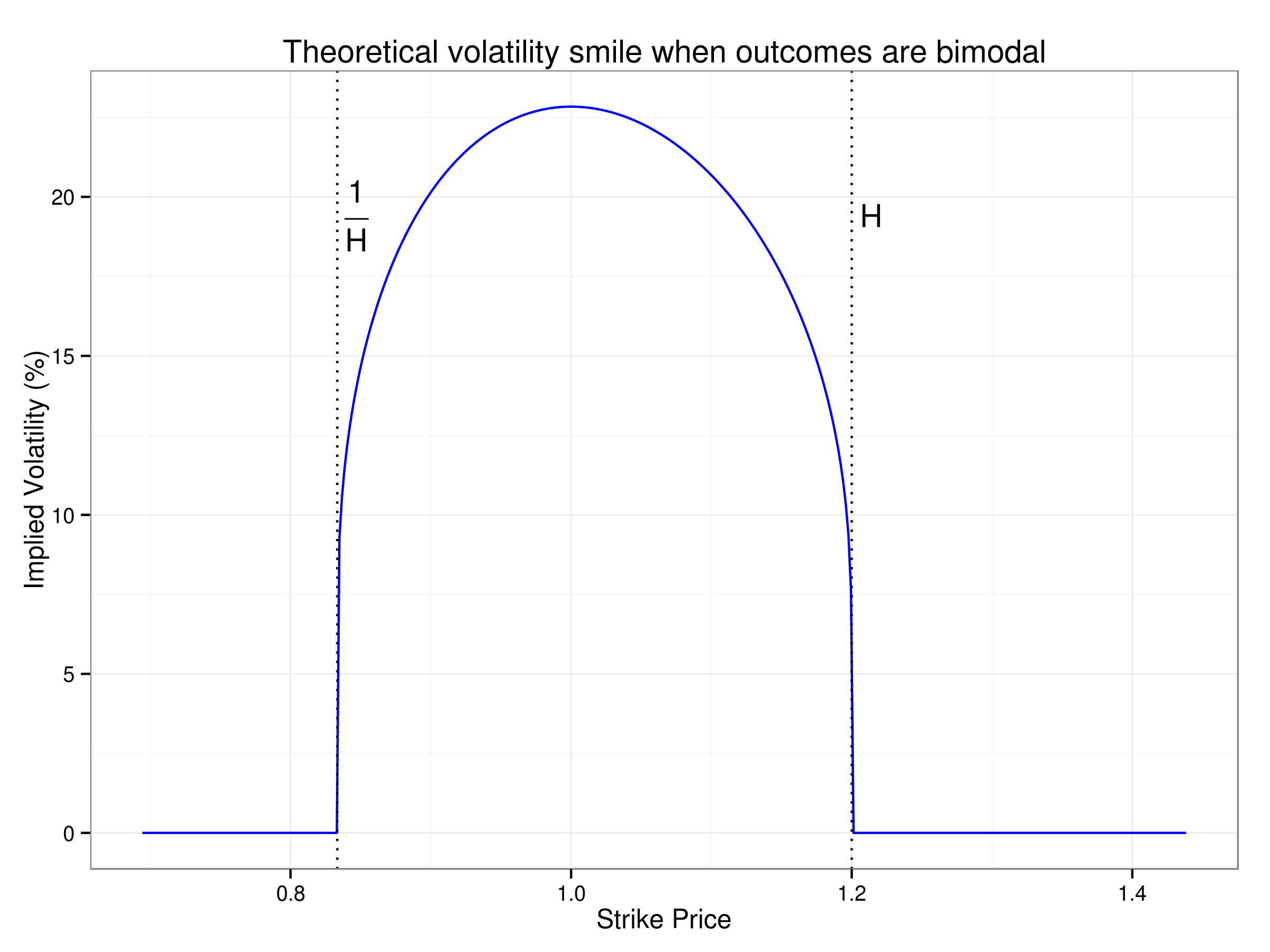

The bimodal example tells us that even with thin tails and no under estimation of volatility (no Black Swan events), there can be significant opportunities in the option market arising purely from the shape of the distribution. How would one detect whether the market is already implying a bimodal outcome? This is easily done by looking at the volatility smile. If the market is using a bimodal distribution, the volatility smile would be an inverted U shape which is very different from that normally observed in most asset markets.

Posted at 10:19 pm IST on Tue, 9 Apr 2013 permanent link

Categories: derivatives

Comments