Real Estate and Infrastructure Resolution in India

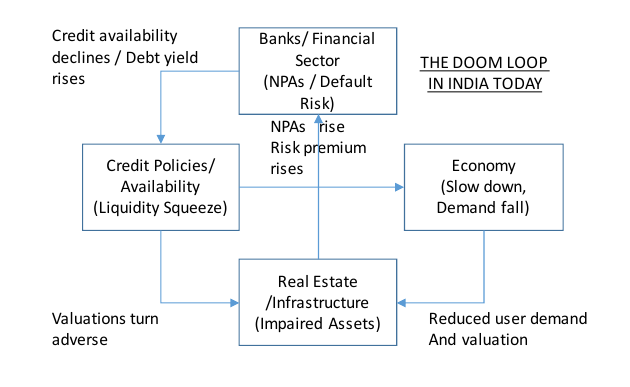

Prof. Sebastian Morris and I have written a working paper on Real Estate and Infrastructure Resolution in India. We argue that real estate and infrastructure is at the centre of a vicious doom loop sketched in the figure below.

This vicious circle needs to be broken decisively, but merely bailing out the failing/ failed developers would only further crony capitalism. Our proposal uses the financial markets for price discovery and resource mobilization, and is based on the sovereign covering the left tail risk in infrastructure and real estate. The mechanism has the potential to revive these assets with the government earning a handsome return, while being fair to all stakeholders.

Our rationale for the sovereign to absorb the tail risks posed by the doom loop are:

Being non-tradeable, real estate and infrastructure cannot fall back on a market outside the narrow demand territory. A tradeable sector asset like a steel plant has a floor asset value based on border prices of inputs and outputs even in a situation where domestic demand has collapsed. This truncates the left tail of the asset value distribution and mitigates the tail risks of the tradeable goods sector. There is no floor on Real Estate and Infrastructure asset values independent of the state of the domestic economy. There is no alternate value to assets in harness – all costs are sunk and non-deployable outside the business and the space.

Real estate and infrastructure are also exposed to sovereign risk (environmental regulation and government policy). Conversely, the government can unlock vast social and private values by removing distortions in the regulation of this sector.

This creates an opportunity for the sovereign to charge a fair insurance premium for providing tail risk cover, and thereby make a profit from the whole transaction in the long run. Our mechanism involves a second loss cover structure similar to the Maiden Lane transactions in the United States in the aftermath of the Global Financial Crisis.

We propose to use financial markets to discover fair prices of diversified pools of real estate assets. Diversified pools overcome problems of asymmetric information, and enable the use of standard valuation models like hedonic regression. More details are in the working paper.

Posted at 9:36 pm IST on Mon, 23 Sep 2019 permanent link

Categories: bankruptcy, crisis

Comments